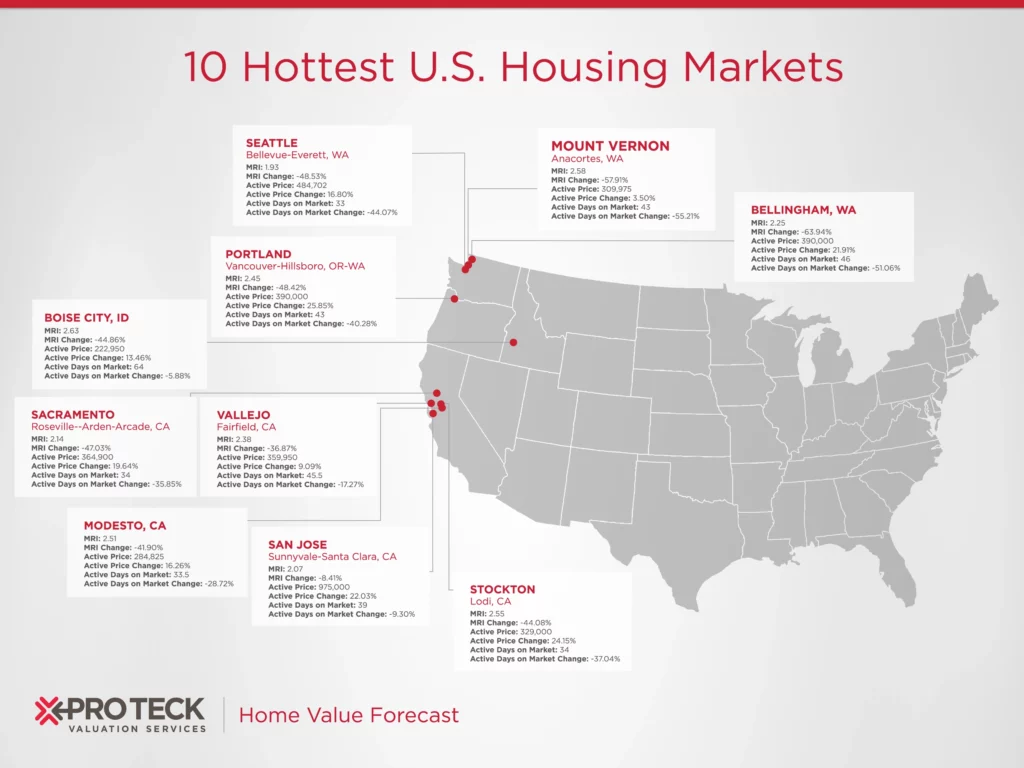

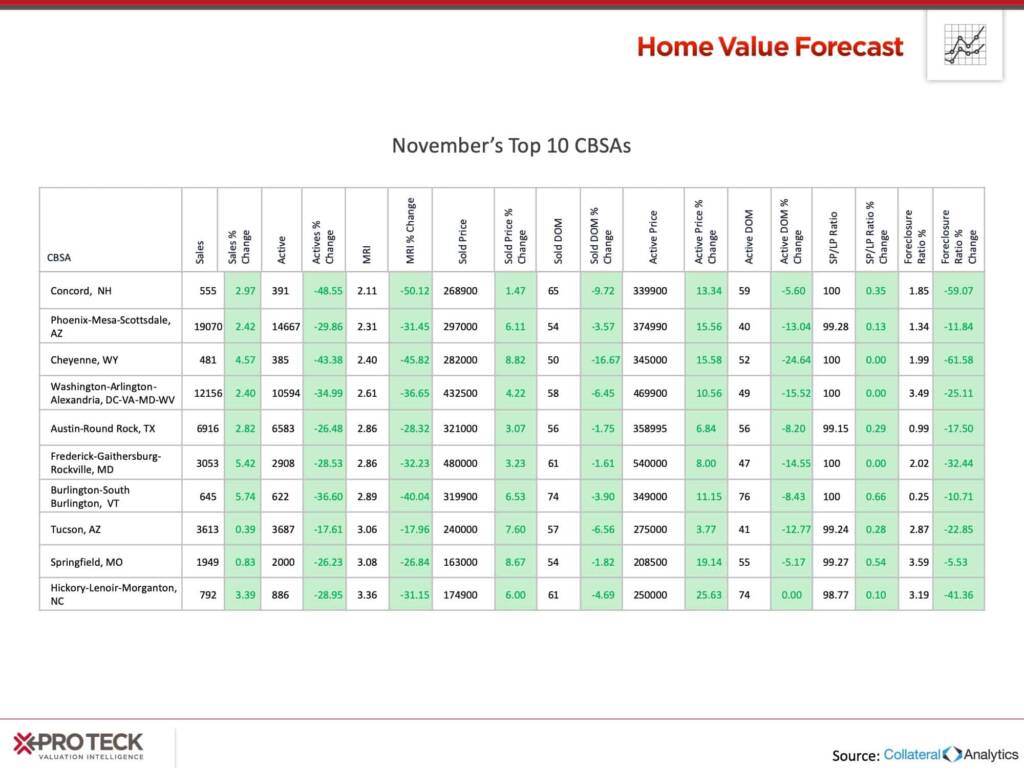

Each month, Home Value Forecast uses a number of leading real estate market-based indicators to report on activity in the single-family home markets in the top 200+ metropolitan areas (CBSAs) in the U.S., and reports on the Top 10.

THE TOP 10

The Home Value Forecast Top 10 ranking system is purely objective and is based on directional trends. It’s not a listing of what markets are most expensive or most in need of inventory — it ranks market momentum at a specific point in time.

This month’s Top 10 metros includes two from Arizona – Phoenix and Tucson.

ARIZONA

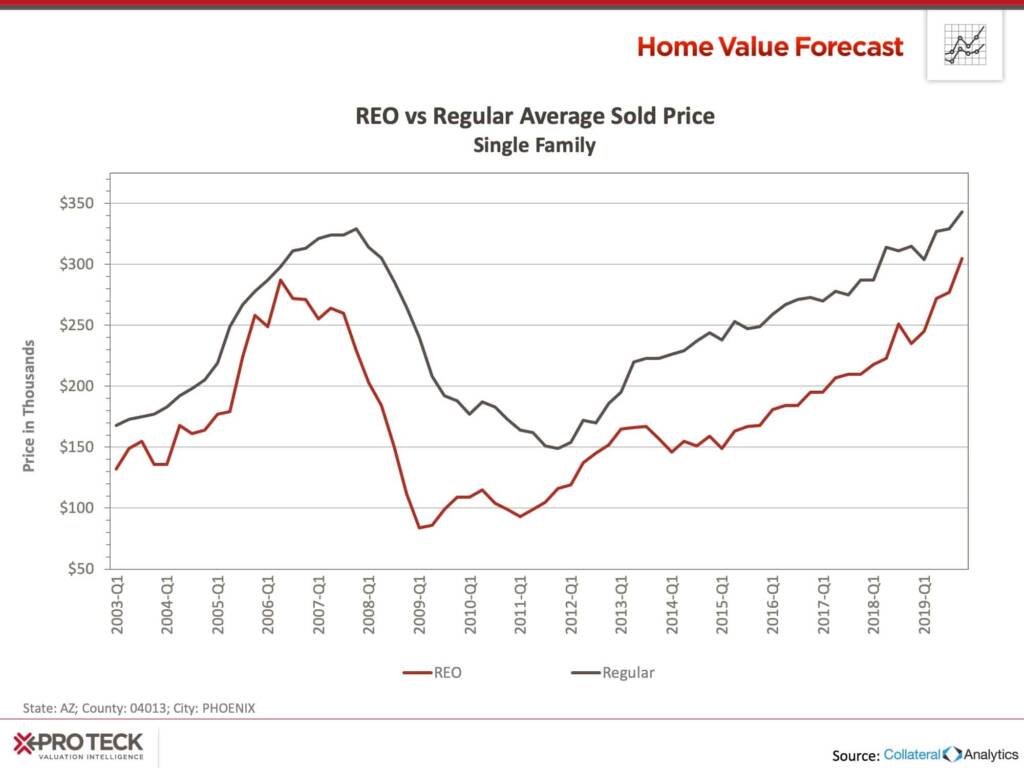

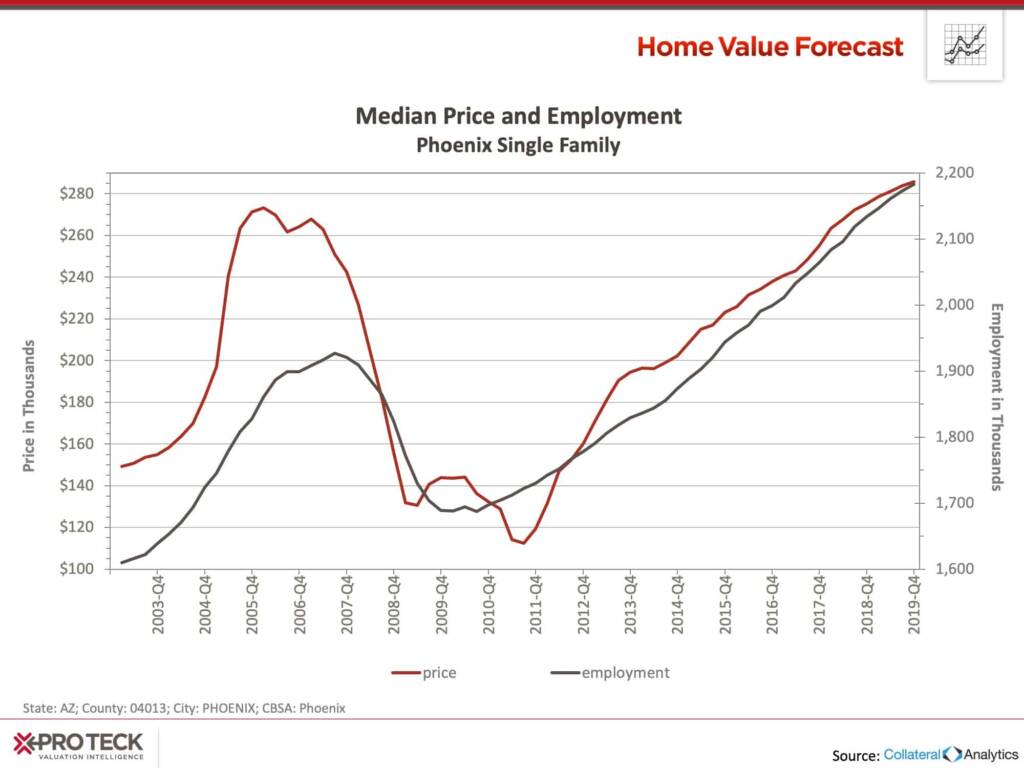

Arizona real estate has been in a consistent upswing since 2012, after a four-year skid where home prices lost 55% of their value (Phoenix).

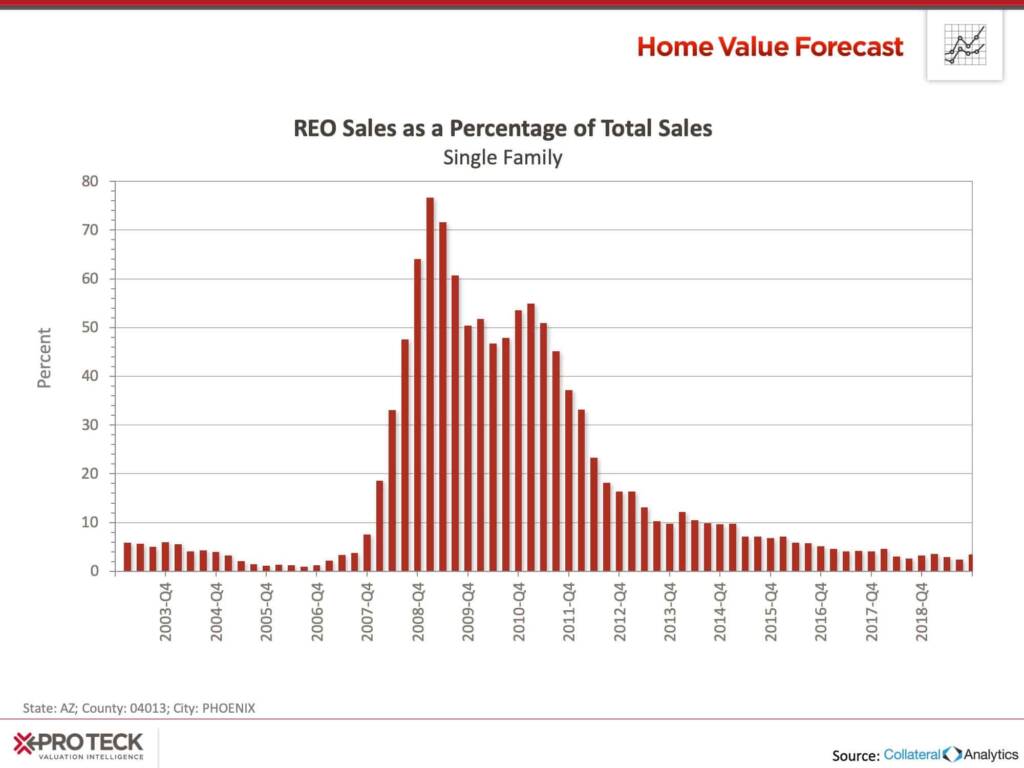

Between 2008 and 2012, home prices were dragged down by Real Estate Owned (REO) sales making up between 40-60% of total sales. Today, REO is down to its historical 3-5% levels.

From 2012 on, Phoenix’s housing market rebounded. During this time, Phoenix attracted large foreign and U.S. investors, quickly working through its foreclosure inventory and turning many into rentals properties. This triggered historically high rental yields and generally inspired confidence in the housing market.

Today, housing appreciation in Phoenix is tied to supply and demand fundamentals. Employment is on the rise and single-family home prices and listing prices are all rising proportionately.

ABOUT SVI’S MONTHLY HOUSING MARKET REPORT

The Home Value Forecast uses a ranking system that is purely objective and is based on directional trends of nine market indicators. Each indicator is given a score based on whether the trend is positive, negative or neutral for that series. For example, a declining trend in active listings would be positive, as would an increasing trend in average price. A composite score for each CBSA is calculated by summing the directional scores of each of its indicators. From the universe of the top 200 CBSAs, each month we highlight topics and trends in the real estate market.