Intelligent Cascade

Automatic Product Selection Based on your Credit Risk Policy

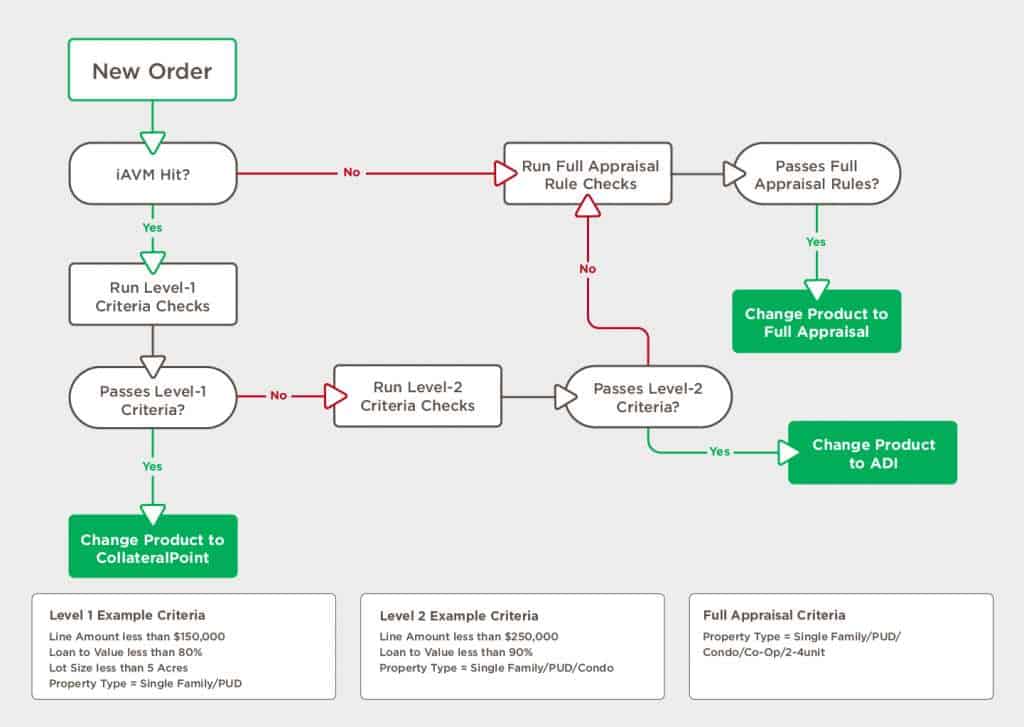

Intelligent Cascade is a rules-based valuation ordering platform that uses property, market, loan and borrower characteristics in conjunction with a lender’s credit risk guidelines to provide an automated product selection and upgrade workflow.

The results are superior turn times, lower costs and a suite of Interagency compliant products.

Stewart Valuation Intelligence’s Home Equity Valuation Products

Stewart Valuation Intelligence offers multiple home equity valuation solutions to use with Intelligent Cascade.

Save with Intelligent Cascade

Many valuation providers have limited solutions that lack configurability, leaving lenders with reduced options, delayed turn times and unnecessary overhead costs.

If you find your institution using high-cost, slow turn-time solutions, or ordering and reconciling multiple products on the same property in order to “get it right,” Stewart Valuation Intelligence’s Intelligent Cascade (IC) will save you valuable time and money.

When the Intelligent Cascade is ordered, property, market, loan and borrower data is plugged into a pre-configured, client-specific, credit risk rules-set that determines the most appropriate product.

Below is an example of IC being used for Home Equity. Based on the client’s credit risk criteria which included property value, loan-to-value, lot size and other variables, either a CollateralPoint, Appraisal Desktop with Inspection (ADI) or Field Appraisal is selected.

In this example, the client had been ordering an AVM with a property inspection, manually reconciling those results to determine if the product was compliant/met internal credit risk policies, then manually determined the appropriate product upgrade for those that didn’t. With IC, the client cut product costs by 13% and turn times by 25%.

IC can be used for Home Equity, and a number of other scenarios including Servicing and Capital Markets. Contact us today to learn how you can save time and money with Stewart Valuation Intelligence’s Intelligent Cascade.

FAQs

How do I order when using Intelligent Cascade?

You just order, there is nothing different that needs to be done on your side. Once Stewart Valuation Intelligence receives the order we use your criteria to deliver the best product.

Does it cost more to use Intelligent Cascade?

No, there is no additional cost for using IC. Schedule your consultation today so you can begin saving time and money tomorrow.

Why does a home equity loan require a valuation?

Lenders require a valuation for every type of home equity loan. They do this to protect themselves from risk of default, in case you can’t repay the loan. It also protects the borrower by having a deeper understanding of your properties current value.

Who pays for the valuation on a home equity loan?

In most cases, the lender orders and pays for the valuation. Stewart Valuation Intelligence can help you control costs by offering different product options depending on risk and underwriting criteria.

I thought I could only use drive-by appraisals for home equity valuations?

Many companies can only provide appraisal-based solutions, limiting your choice. Stewart Valuation Intelligence offers AVM, Agent/Broker and Appraiser derived solutions and can match products to your need and credit-risk policy.

Is there a cost-effective way to add interior photos to a solution?

Stewart Valuation Intelligence’s VALIDITY homeowner guided inspection tool can be used in conjunction with many of Stewart Valuation Intelligence’s solutions to give you a view inside the property in question.

Ready to get started with our team of experts?

Get in touch with us today to speak to one of our real estate valuation experts and learn how SVI can help your organization succeed.