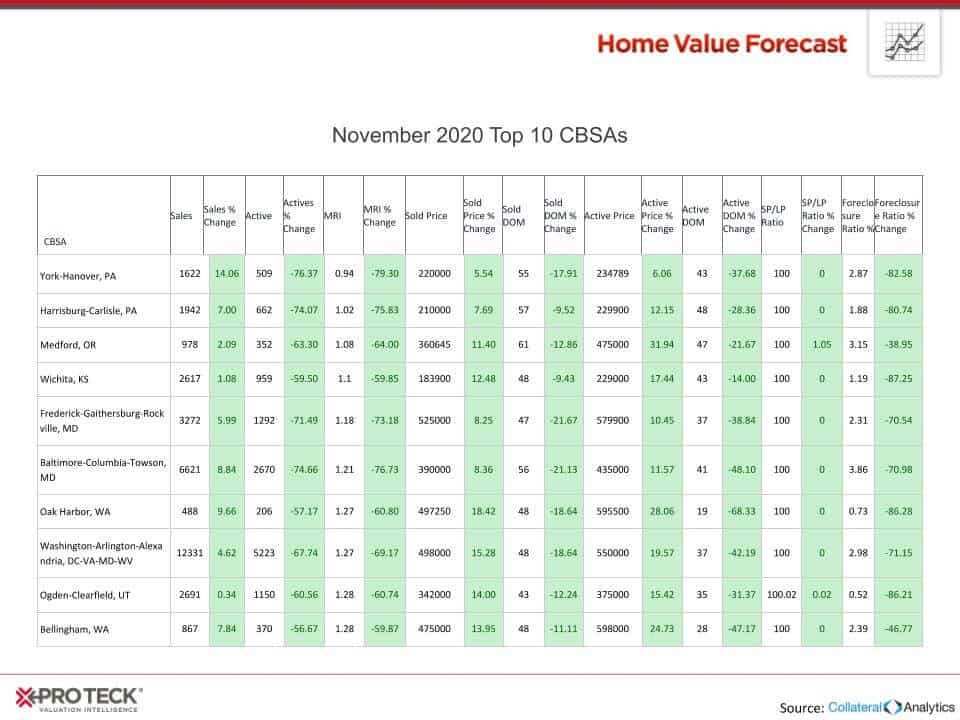

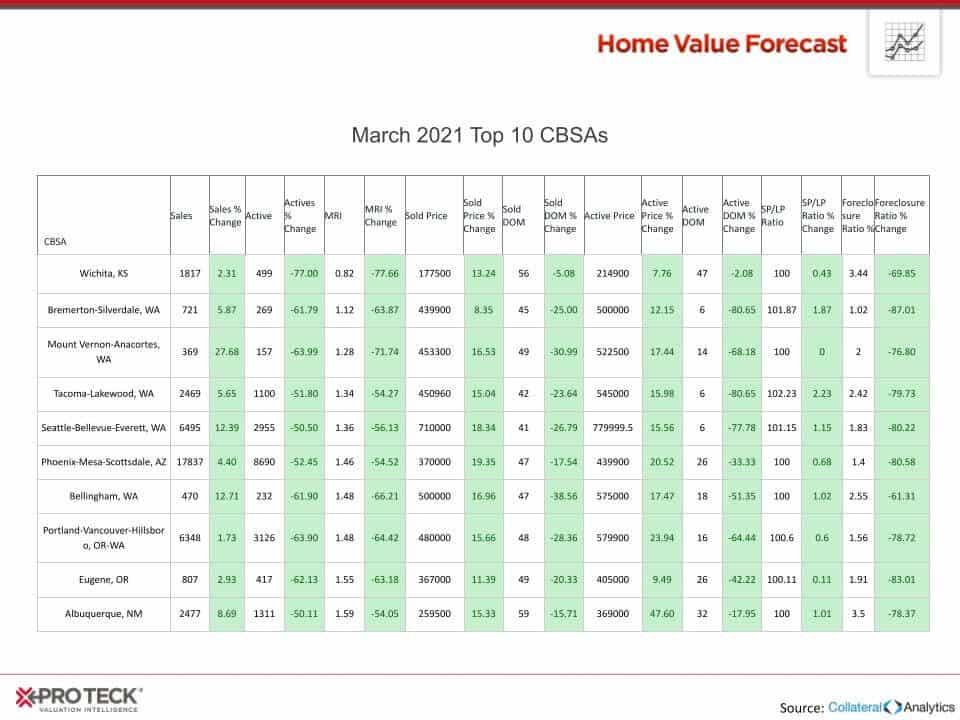

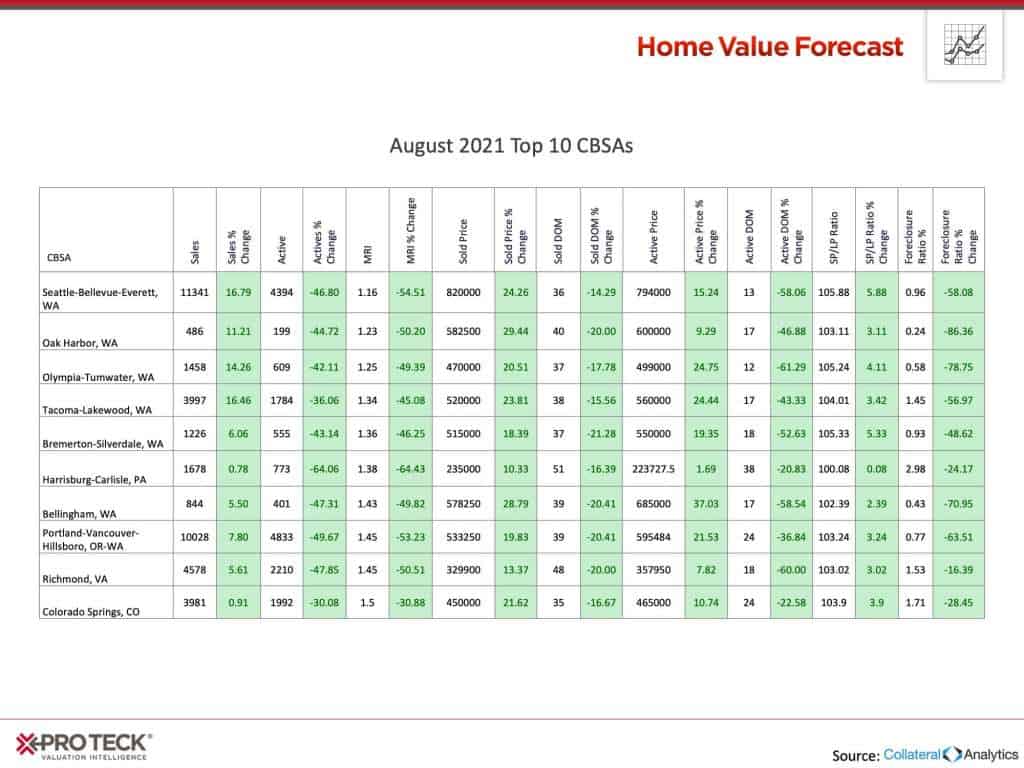

Each month, Home Value Forecast uses a number of leading real estate market-based indicators to monitor single-family home market activity in the nation’s top 200+ metropolitan areas (CBSAs) and report on the Top 10.

THE TOP 10

The Home Value Forecast Top 10 Hottest Housing Markets ranking system is purely objective and is based on directional trends over the past eight quarters. It’s not a listing of what markets are most expensive or most in need of inventory; it ranks market momentum at a specific point in time.

This month’s Top 10 has six metros from Washington state that all had Months of Remaining Inventory (MRI) under 1.5 months:

Also this month, 225 of the 229 metros we track had a sales price to list price ratio of 100% or more. The top 10 performers in that metric include:

Top 10 Sale Price to List Price Ration CBSAs

| CBSA Name | Sold Price | SP_LP_Ratio |

| Oakland-Hayward-Berkeley, CA | 1,150,000 | 111.16 |

| Rochester, NY | 205,500 | 110.5 |

| San Francisco-Redwood City-South San Francisco, CA | 1,886,500 | 111.41 |

| Buffalo-Cheektowaga-Niagara Falls, NY | 225,000 | 108.89 |

| San Jose-Sunnyvale-Santa Clara, CA | 1,625,000 | 108.15 |

| Cambridge-Newton-Framingham, MA | 705,000 | 106.91 |

| Austin-Round Rock, TX | 500,000 | 106.88 |

| Lewiston-Auburn, ME | 243,000 | 106.56 |

| Seattle-Bellevue-Everett, WA | 820,000 | 105.88 |

| Bremerton-Silverdale, WA | 515,000 | 105.33 |

Using San Francisco as an example, if the average single family home sales price is $1,886,500, and those homes are selling for 110.41% of list price, then the average home is selling for $177,869 over asking price. That overage alone is enough to buy a house in many areas of the United States.

ABOUT SVI’S MONTHLY HOUSING MARKET REPORT

The Home Value Forecast uses a ranking system that is purely objective and is based on directional trends of market indicators. Each indicator is given a score based on whether the trend is positive, negative or neutral for that series. For example, a declining trend in active listings would be positive, as would an increasing trend in average price. A composite score for each CBSA is calculated by summing the directional scores of each of its indicators.