The Wall Street Journal recently published an article titled Why New Jersey’s Soaring Foreclosures Are Good for the Housing Market. The report reveals that foreclosures in New Jersey are at an all-time high, and that bank-owned properties may help “as the market is starved for inventory.”

While more inventory is a good thing for a healthy housing marketplace, foreclosures primarily benefit investors who convert them into rental properties. The impact to other homeowners is not always positive. Let’s look at Newark and Jersey City — two areas seeing very different impacts as a result of foreclosures.

Newark, NJ

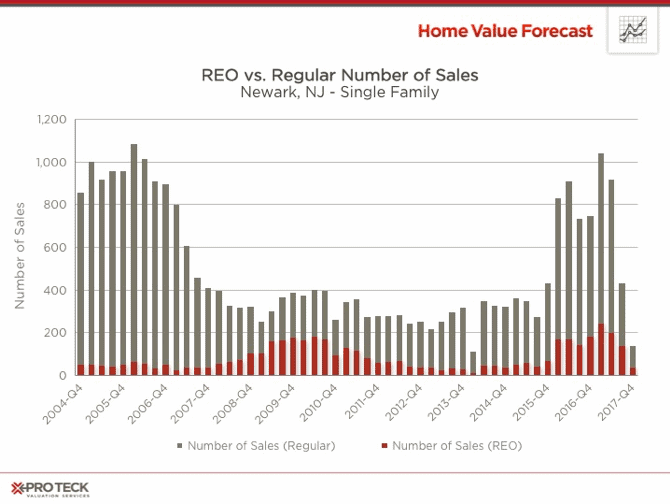

The Newark, NJ, real estate market will not benefit from more foreclosed properties. Foreclosures are already at an all-time high, surpassing 2010 volume.

If there are many foreclosed homes in a neighborhood, it starts to impact regular market sales, a phenomenon known as the “contagion effect” of foreclosed properties.

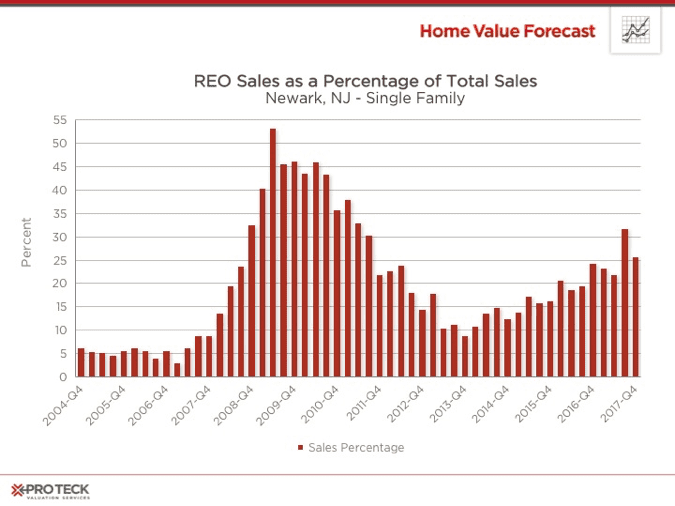

REO sales as a percentage of total sales under 10% has little impact on market prices, but they do at the 25% Newark is experiencing today.

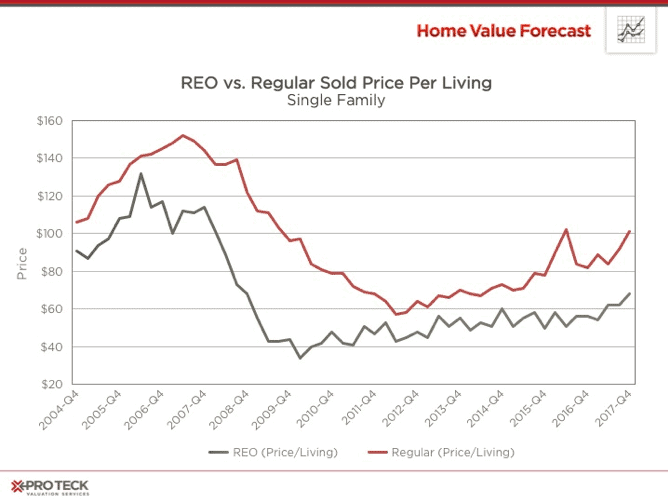

Below is a comparison of REO versus Regular Sale sold price per square foot of living area in Newark. In times of a “hot” market, like in 2006 and 2012, the difference in price between REO and Regular sale begins to tighten, as the REO discount shrinks.

Unfortunately, the REO discount has been growing in recent years, keeping prices well below past highs with no real change in site.

As for the lack of inventory, think of a person who bought a 2,000-square-foot home in 2005 for $260,000 that is now worth $162,000. That person can’t afford to sell, and would rather see fewer foreclosures so prices rebound quicker.

Jersey City, NJ

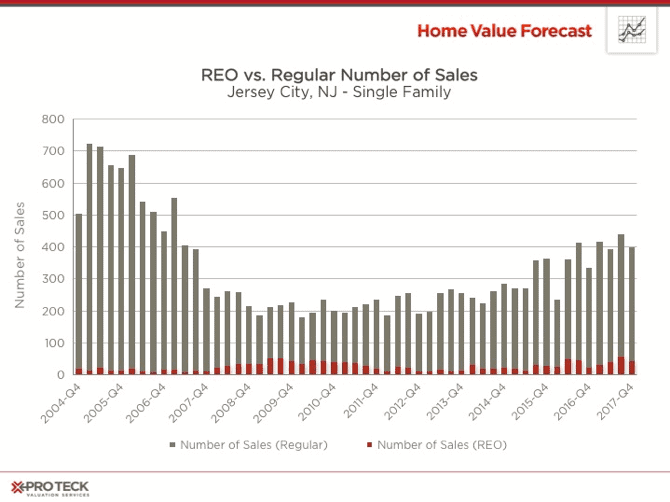

Jersey City is in much better shape. The number of REOs, while creeping up, is not experiencing the wild peaks seen in Newark.

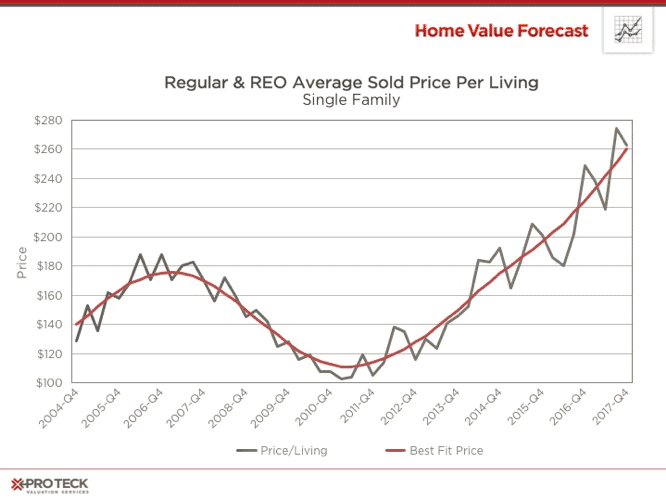

REO Sales as a percent of total sales has averaged under 10% for the last few years, thus not negatively impacting market price.

Because of this, Jersey City prices have rebounded nicely—surpassing pre-crash highs more than three years ago.

Using the same example as a person in Newark who bought a 2,000-square-foot home in 2005, in Jersey City that home price has appreciated from $365,000 to almost $520,000. In this instance, regular sales have increased along with the increase in REO inventory and has not negatively impacted the overall health of the market.

About Home Value Forecast

Home Value Forecast (HVF) is brought to you by SVI. HVF provides insight into the current and future state of the U.S. housing market, and delivers 14 market snapshot graphs from the top 30 CBSAs.

HVF is built using numerous housing and economic data sources. The top 750 CBSAs as well as data down to the ZIP code level for approximately 18,000 ZIPs are available with a corporate subscription to the service.

Also, SVI offers reporters the following:

- National, regional or metro level housing data

- Monthly updates and HVF insight articles

- By-request data for your story — custom data, heat maps and charts are available

- Expert commentary from Home Value Forecast Editorial Committee:

- Tom O’Grady, Chief Executive Officer, Pro Teck Valuation Services

- Michael Sklarz, Ph.D., President, Collateral Analytics

- Jeff Dickstein, Chief Compliance Officer, Pro Teck Valuation Service