This is a summary of key takeaways from Fannie’s most recent update:

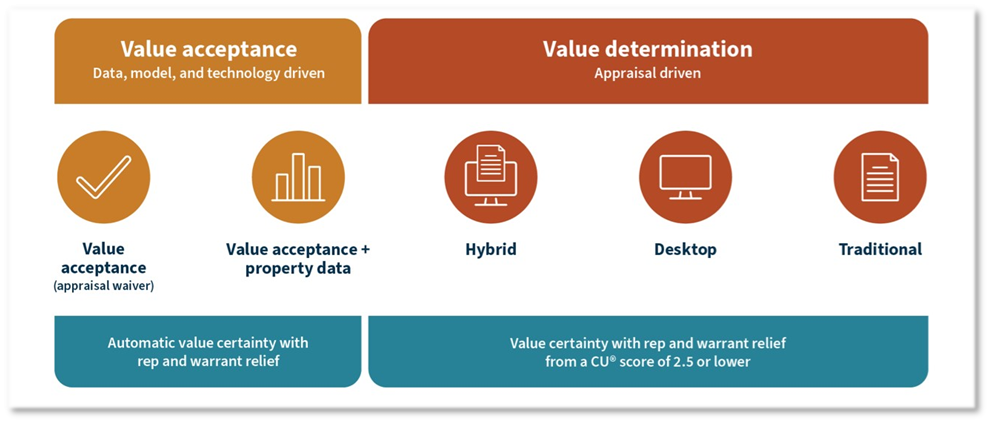

Value Acceptance is the new name of Appraisal Waivers

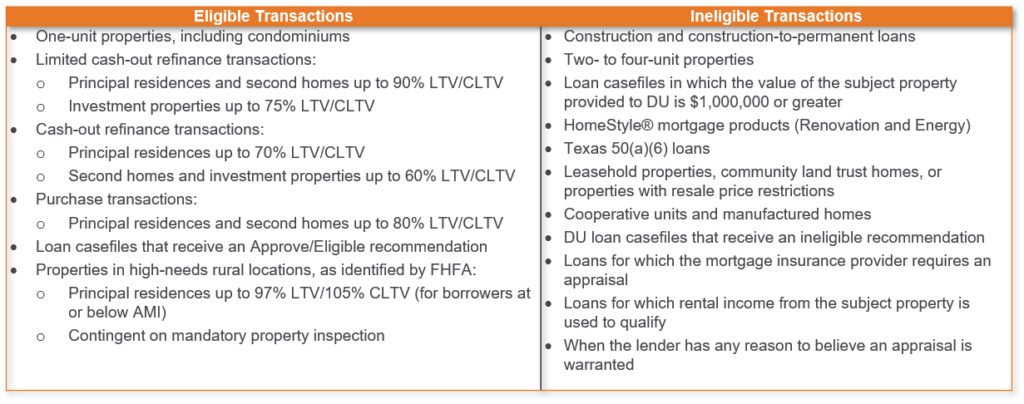

Value acceptance (appraisal waivers), offered through Desktop Underwriter® (DU®) and powered by Collateral Underwriter® (CU®), are offers to waive the appraisal for eligible transactions. These include:

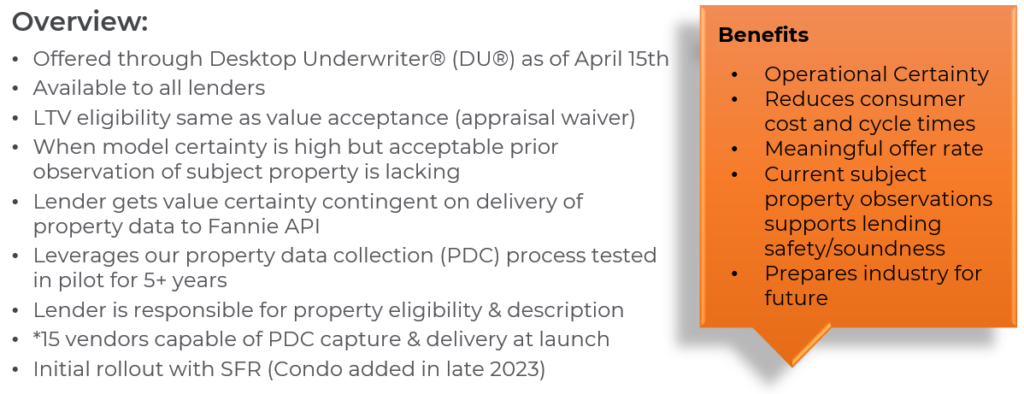

Value Acceptance + Property Data

Property data is collected by a trained and vetted third party (real estate agent, insurance inspector, appraiser, etc.). Lender reviews data and warrants property eligibility. It is the lender’s responsibility to verify and demonstrate that the data collectors are vetted with annual background checks, professionally trained, and have the knowledge to competently complete the data collection.

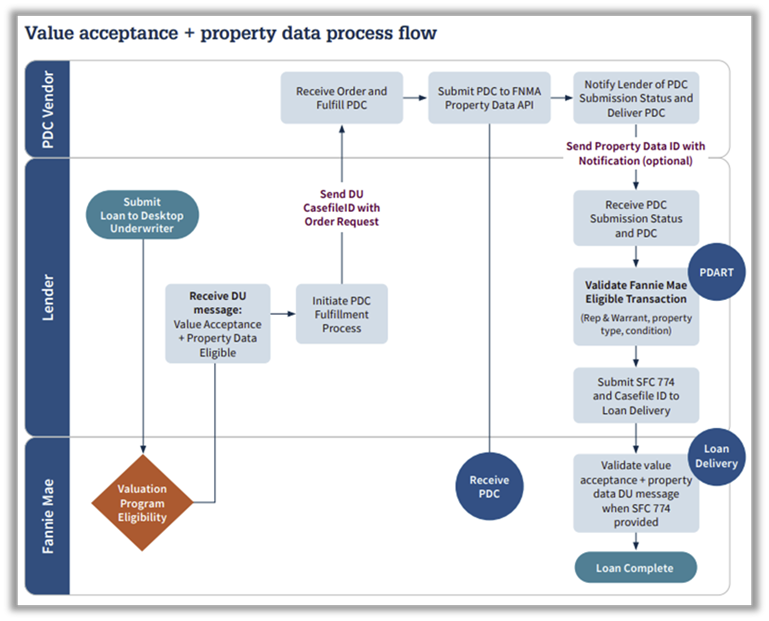

Value Acceptance + Property Data

Property Data Collection (PDC)

PDC consists of a full interior and exterior inspection of the subject property. The data collection can be performed by a trained and vetted third party. Requirements include 20 data points describing the property, 40-60 photos (minimum standards for image resolution, light level, and clarity) and an ANSI compliant floorplan.

The property data collection (PDC) consists of a full interior and exterior inspection requiring the capture of data and images throughout the subject property. Only a single visit to the subject property is required to complete this process.

The data collection can be performed by a trained and vetted property data collector and must adhere to Fannie Mae’s Property Data Standard. See the Property Data API Resources page for more information. Once the PDC is collected and passes quality controls checks, it must be submitted to Fannie Mae’s Property Data API.

The property data collection (PDC) consists of a full interior and exterior inspection requiring the capture of data and images throughout the subject property. Only a single visit to the subject property is required to complete this process. The data collection can be performed by a trained and vetted property data collector and must adhere to Fannie Mae’s Property Data Standard. See the Property Data API Resources page for more information. Once the PDC is collected and passes quality control checks, it must be submitted to Fannie Mae’s Property Data API.

Stewart Valuation Intelligence Solution

SVI’s property data solution is its VALIDITY Pro inspection application, optimized for mobile phones or tablets. With VALIDITY Pro, an SVI broker/agent conducts a full property inspection to collect all required data, including:

Digital floor plan, with dimensions and calculations.

- Collecting a comprehensive set of subject property photographs.

- Identifying property characteristics in the property data set.

- Examining adverse property conditions.

- Analyzing functional and external obsolescence.

Property data collector training and an exam are utilized to ensure the proficiency of the property data collector. SVI’s national broker/agent network are trained, vetted and pass yearly background checks. Most importantly, our customers can rely on our national broker/agent network that has been built over 30 years – you don’t have to rely on unknown third-party providers.

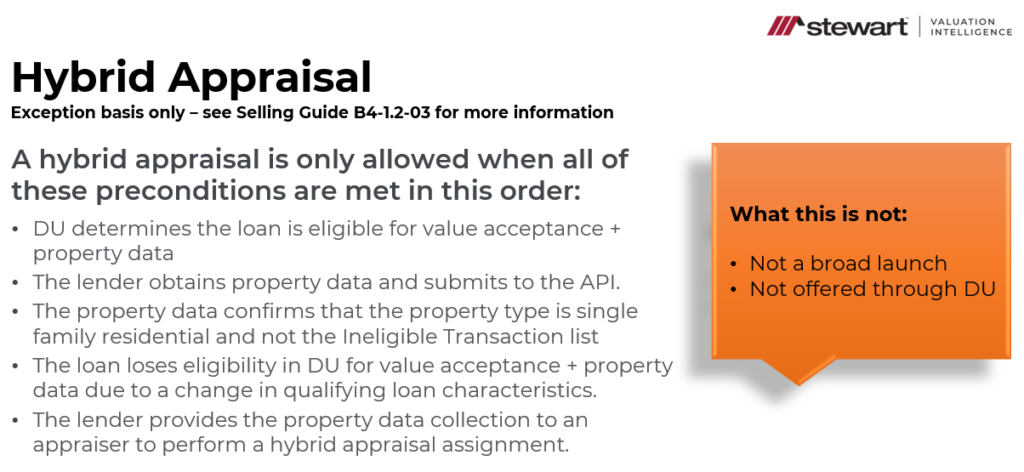

Hybrid Appraisal

Property data collected by a trained and vetted third party (real estate agent, insurance inspector, appraiser, etc.) is passed to an appraiser to perform an enhanced version of a desktop appraisal. For loans that do not qualify for value acceptance or do not have reliable prior observations of the subject property.

Desktop Appraisal

Appraiser completes the appraisal without physically inspecting the property, using data from various sources (agents, homeowners, MLS, tax records, etc.). Best suited for purchase transactions.

Traditional Appraisal

Appraiser collects the property data and completes the market analysis required for the appraisal. For complex property types or situations where data is sparse.

Stewart Valuation Intelligence is ready for appraisal modernization. If you have any questions, please reach out to your Representative or contact us. Thank you.