Home Value Forecast

Home Value Forecast: Does Quality of School System Impact Home Prices?

One of the biggest reasons people move, in addition to job opportunities and needing more/less space, is because they want a better education for their children. But a better education means a certain type of school, and a certain type of school may end up meaning a pricier home.

In this month’s Home Value Forecast, we look at the impact school reputation has on home prices — particularly whether a homebuyer can expect to pay more for a similar home in an area with a good school system.

In Manchester, Mass., for example, the school system is ranked 12th in the state and 334th in the nation. In 2017, the average home in Manchester sold for $866,500, the 14th highest in the state. But while towns surrounding Manchester have good schools, they don’t rank in the top 500 nationally, and homes average significantly less — around $450,000.

So, is the $400,000-plus price difference all due to the school system? The answer is this case is, no. The towns have different housing stock, different housing density, different industry, different municipal amenities and taxes — all of which have an impact on price.

But what about homes in neighborhoods that are divided into different school systems?

A Closer Look at Housing Values & School Quality

To truly see the impact schools have on home prices, you need to research neighborhoods split by school systems — a study by Collateral Analytics did just that.

In a recent white paper about housing values and school quality, Collateral Analytics explored how much school quality impacts residential home prices and how stable those premiums are over time. The report looks at areas in Cincinnati and Mission Viejo, CA, where neighborhoods are split by school districts.

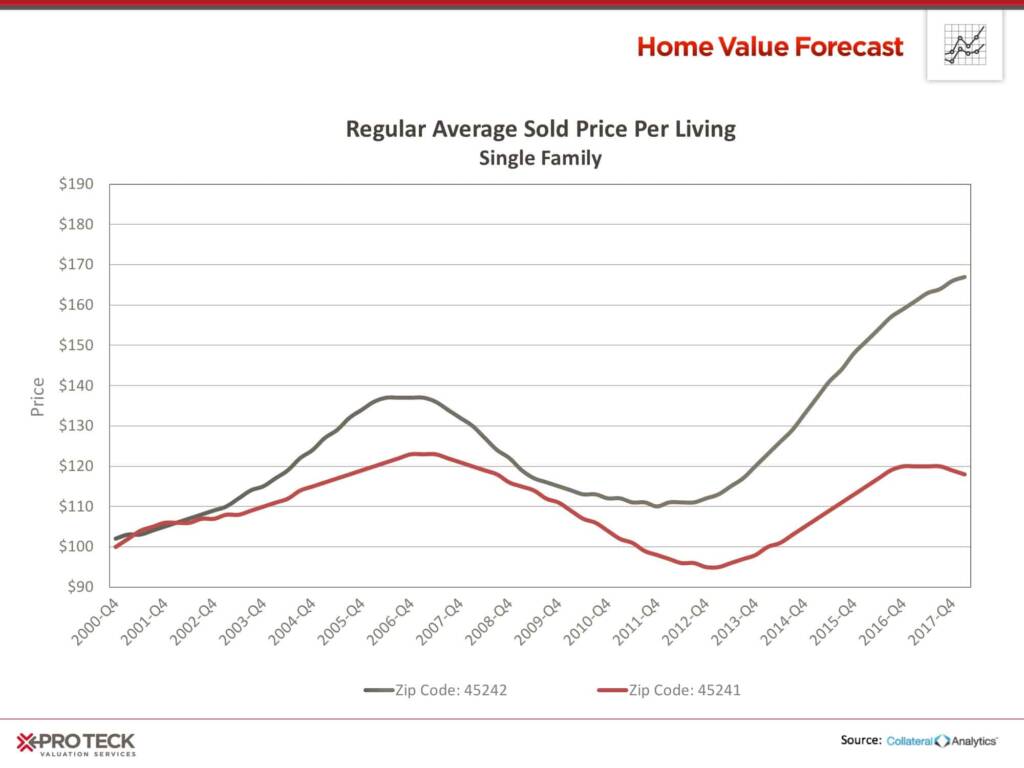

In Cincinnati, the report found two similar homes in the same neighborhood, two miles apart. One home was valued at $137 per square foot, the other $217, a 58% difference. This phenomenon can also be seen at the ZIP code level:

In this case, the school district appeared to be the main driver of this price difference.

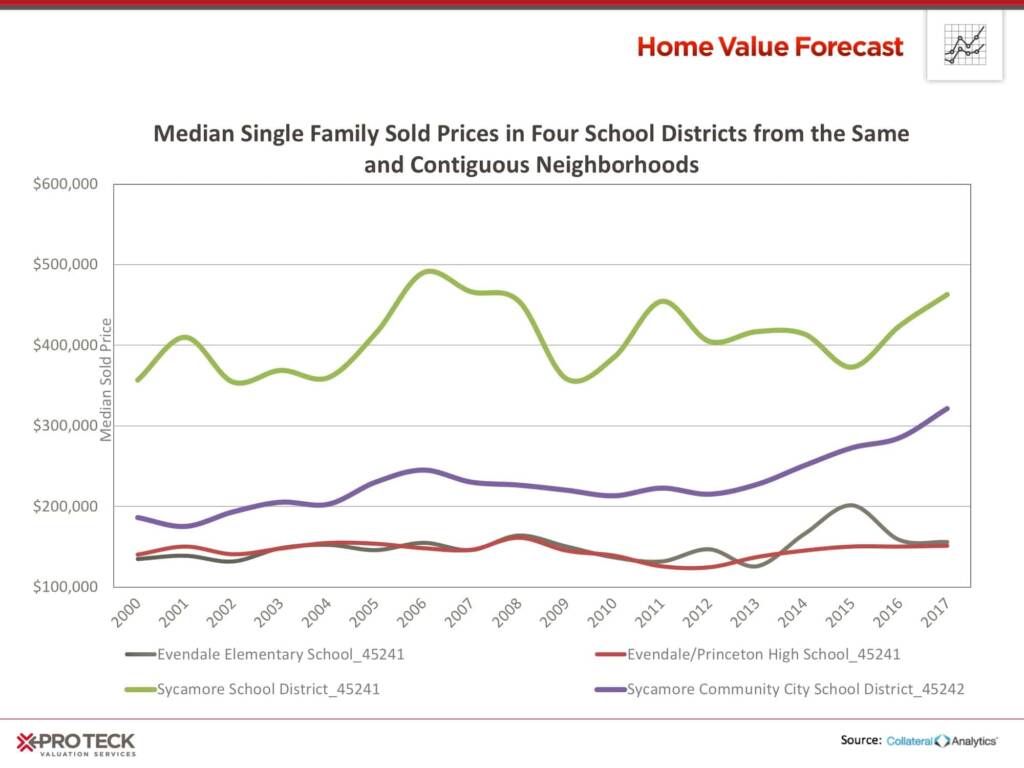

In this particular section of Cincinnati there are two high schools, five miles apart. Sycamore High School gets a greatschools.org rank of 8 out of 10, and a 10 for “college readiness.” The other school, Princeton High School, received a greatschools.org rating of 3, and a matching 3 for “college readiness.” These differences are reflected in home prices.

Their research has enabled Collateral Analytics to create median home price series for the housing stock by school and school district. What it shows is that above average school quality is capitalized into value of a home, just like an income stream.

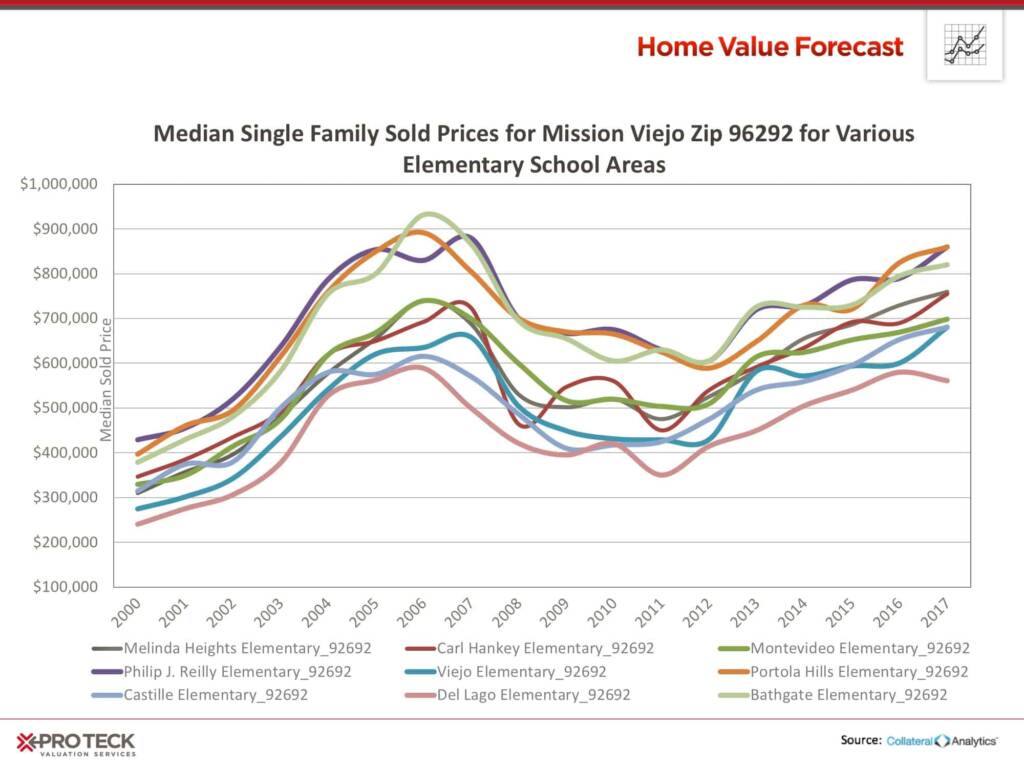

Data further suggests that elementary school may matter even more than high school in driving locational preferences of homebuyers with children, as can be seen in Mission Viejo, CA. While the overall trend lines for the nine elementary schools were similar, there is a $300,000 home price spread.

Furthermore, a report released by the National Bureau of Economic Research helps solidify the idea that communities that invest in their schools in an effort to improve quality experience a direct impact on property values.

According to the NBER report, Using Market Valuation to Assess Public School Spending, there is a definite correlation between school expenditures and home values in a given neighborhood — every additional dollar spent in per pupil state aid increases home values by about $20

Collateral Analytics is in the process of refining this research to further isolate the influence of school system on home price for the entire U.S. Stay tuned as we look forward to learning more about this important market trend.

About Home Value Forecast

Home Value Forecast (HVF) is brought to you by SVI. HVF provides insight into the current and future state of the U.S. housing market, and delivers 14 market snapshot graphs from the top 30 CBSAs.

HVF is built using numerous housing and economic data sources. The top 750 CBSAs as well as data down to the ZIP code level for approximately 18,000 ZIPs are available with a corporate subscription to the service.

Also, SVI offers reporters the following:

- National, regional or metro level housing data

- Monthly updates and HVF insight articles

- By-request data for your story — custom data, heat maps and charts are available

- Expert commentary from Home Value Forecast Editorial Committee:

- Tom O’Grady, Chief Executive Officer, Pro Teck Valuation Services

- Michael Sklarz, Ph.D., President, Collateral Analytics

- Thomas Hoff, VP, Marketing & Communications, Pro Teck Valuation Services

- Jeff Dickstein, Chief Compliance Officer, Pro Teck Valuation Service