Happy Holidays from Stewart Valuation Intelligence!

For the final Home Value Forecast of the year, we will examine trends over the past 12 months and list the top three CBSAs in the following categories:

- Highest Current Sales Price

- Current Months of Remaining Inventory

- 12 Month Sales Price Appreciation

This will be the seventh year we have done this year-end analysis.

CURRENT SALE PRICE

For 2020, the three California metros of San Francisco, San Rafael and San Jose earned a place atop the list of CBSAs with the Highest Current Sales Price. These three metros have been leading this category since we started this review in 2014.

The numbers:

While appreciation cooled in 2019 (all at .5% or below), it is back in 2020 with the three metros all experiencing significant price appreciation.

In all, California CBSAs accounted for 12 of the top 15 spots in this category — with Vineyard Haven, MA (#4), Honolulu, HI (#7) and Boulder, CO (#15) being the others.

MONTHS OF REMAINING INVENTORY (MRI)

MRI is another indicator of how “hot” a market is at a particular time. MRI equals the number of households on the market divided by the number that sell per month. If an area has a high MRI (let’s say 10 months), it means that the market is saturated — a buyer’s market. If MRI is low (below three months) then it becomes a seller’s market. A “balanced” market will have approximately six months of inventory at any given time.

The top three markets in terms of MRI for 2020 are:

In total, there are 177 CBSAs with MRIs under three months – more than triple the 49 we had last year. This is clearly due to the impact of COVID-19 limiting the number of homes on the market.

As of this month, 224 of the 229 CBSAs we track have MRI below the six months “balanced” market threshold.

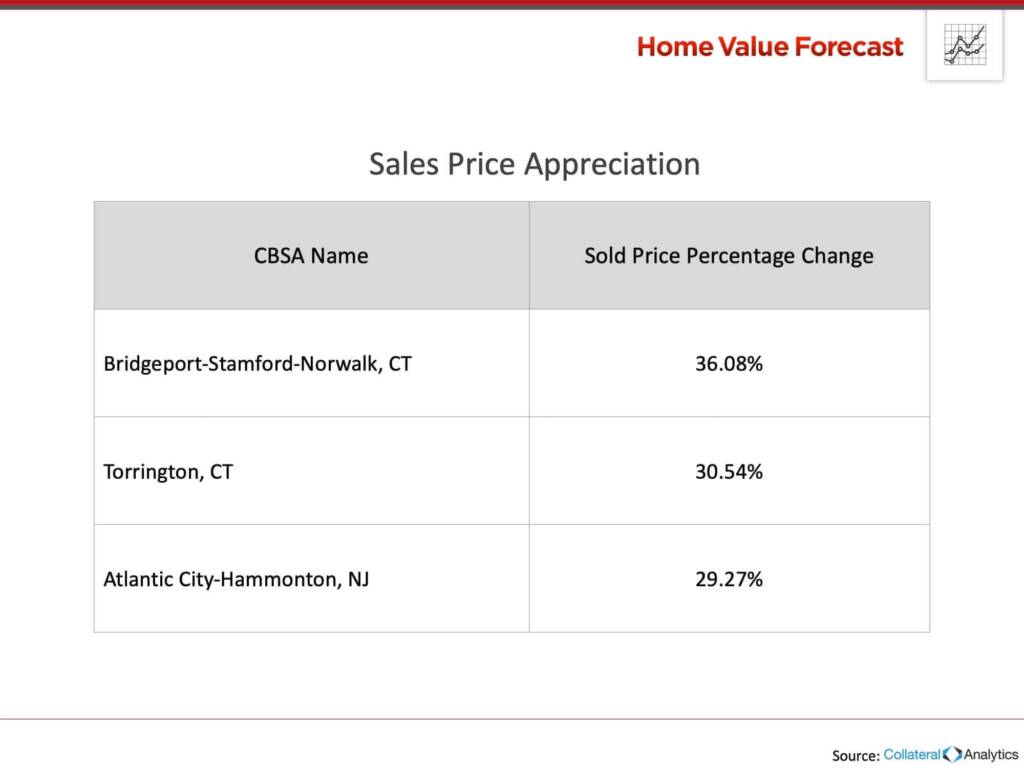

12-MONTH SALES PRICE APPRECIATION

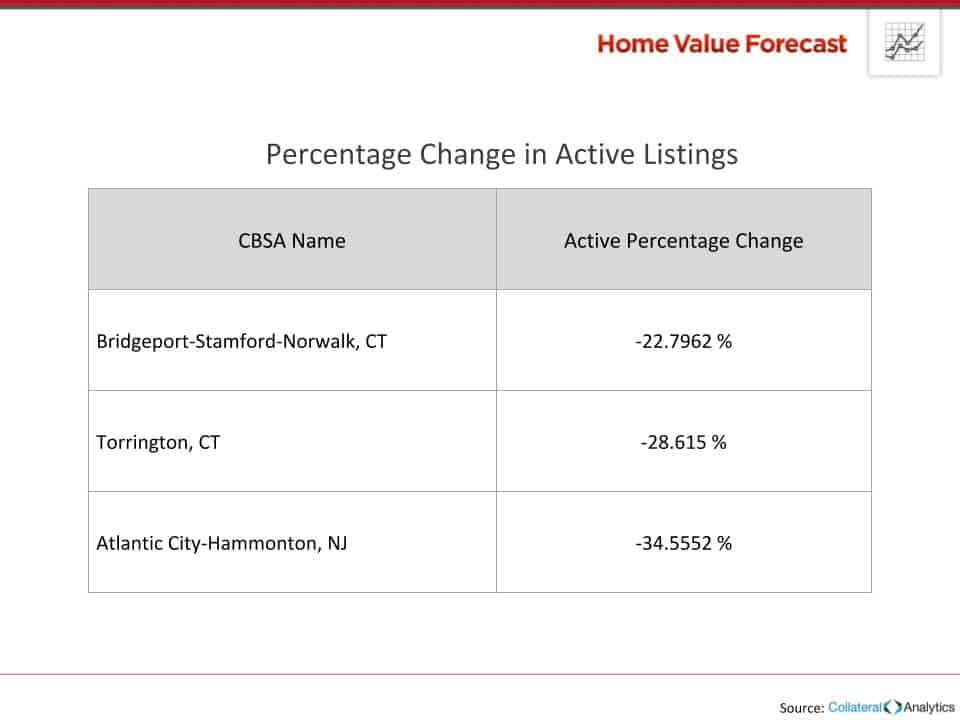

In our report, sales price appreciation is calculated as the rolling three-month average sale price compared to the same three-month time period from the previous year. Our top three all had more than 29% appreciation from the same time last year:

Bridgeport, Torrington and Atlantic City are not regulars on our Top 10 list. They all have fewer homes for sale than a year ago (-23% to -35% drop in active listings), which has driven prices higher.

The 2021 real estate market will be dependent on how fast the COVID vaccination can be rolled out and schools, work and society return to some semblance of normal. Here’s hoping we can go to the movies before the year is out.

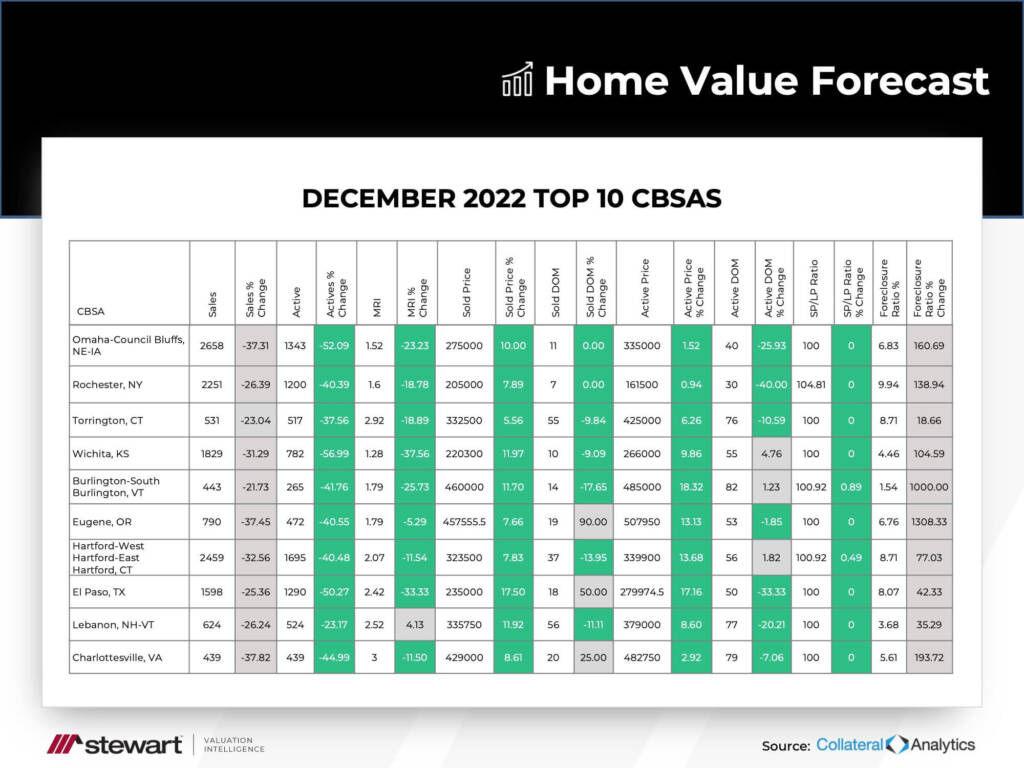

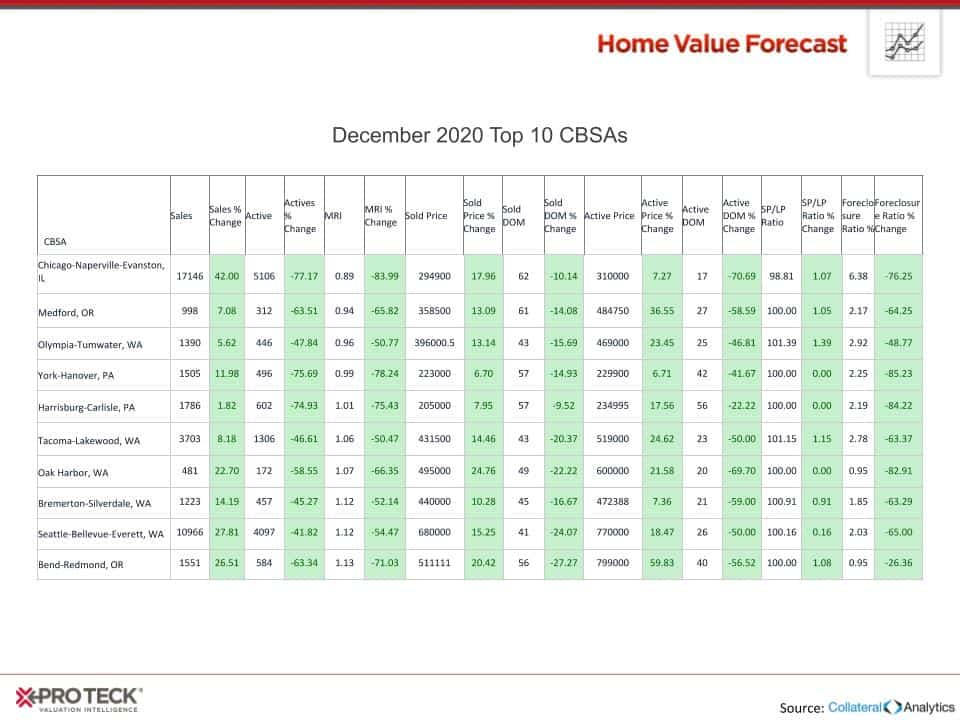

This month’s Top 10

Each month, Home Value Forecast uses a number of leading real estate market-based indicators to report on activity in the single-family home markets in the top 200+ metropolitan areas (CBSAs) in the U.S., and reports on the Top 10.

The Home Value Forecast Top 10 ranking system is purely objective and is based on directional trends. It’s not a listing of what markets are most expensive or most in need of inventory — it ranks market momentum at a specific point in time.

THE LAST TOP 10 OF 2020

From all of us at SVI, we hope you and your family have a happy and healthy 2021!

ABOUT SVI’S MONTHLY HOUSING MARKET REPORT

The Home Value Forecast uses a ranking system that is purely objective and is based on directional trends of nine market indicators. Each indicator is given a score based on whether the trend is positive, negative or neutral for that series. For example, a declining trend in active listings would be positive, as would an increasing trend in average price. A composite score for each CBSA is calculated by summing the directional scores of each of its indicators. From the universe of the top 200 CBSAs, each month we highlight topics and trends in the real estate market.