Stewart in the Studio

Driving Efficiency and Savings in Default Servicing

Stewart in the Studio, hosted by Marvin Stone, SVP, Strategic Initiatives, is a fast-paced monthly podcast focused on issues vital to the mortgage lending industry. Tune in each month as Marvin and industry thought leaders discuss important trends and timely topics.

To speak to a Stewart Lender Services expert, please fill out the form to the right – we will get back to you shortly.

Stewart in the Studio Form

Episode Notes

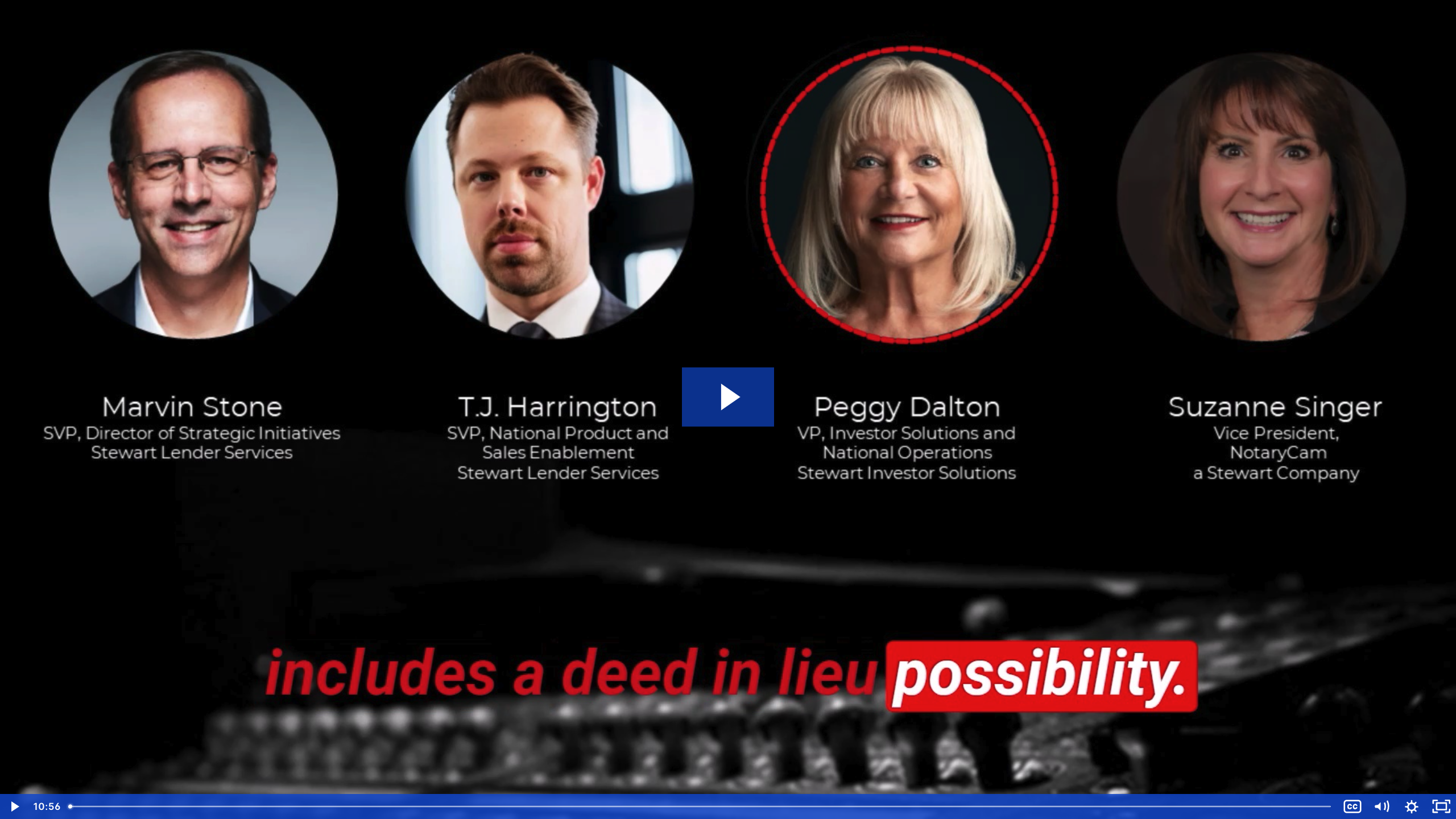

- Guests include: T.J. Harrington, SVP National Product and Sales Enablement; Peggy Dalton, VP Investor Solutions; and Suzanne Singer, Director Sales and Marketing.

- Our experts talk about the common pain points that servicers face, such as operational inefficiencies, and rising costs, then share how Stewart can address these challenges with its comprehensive suite of services.

- From origination to post-closing, across performing and non-performing loans, Stewart has the expertise and technology to support servicers of any scale.

Speaker Bios

Speakers for this episode include:

Marvin Stone

As Senior Vice President, Director of Strategic Initiatives for Stewart Lender Services, Marvin Stone is working on the digital transformation of the transaction process for Stewart’s full range of services that cover the entire mortgage lifecycle. He also contributes to industry technology by participating in MBA’s MISMO Title and Settlement Community of Practice and being part of Stewart’s generative AI council.

Stone has been with Stewart since 2007 and has managed various technology, process and compliance initiatives for the direct, agency and centralized title divisions. Before joining Stewart, he was CIO for a large title company on the West Coast and held strategic roles with other national underwriters and mortgage lenders.

Stone is a frequent speaker at industry events and is sought out for his commentary on industry trends.

Episode 6 Transcript

View Full Transcript

E6: Driving Efficiency and Savings in Default Servicing

Marvin Stone: Welcome everyone to this week’s episode of Stewart In The Studio. Today, our thought leaders include TJ Harrington, Peggy Dalton, and Suzanne Singer. TJ, Stewart’s been around for 130 years.

So there’s this perception that we only do title and escrow for purchase and refi transactions, the same core competency there. Can you shed some light on Stewart’s approach to supporting lenders through the entire mortgage life cycle?

T.J. Harrington: Absolutely. Marvin, we’re a 130 year old company, but in a lot of ways, we are run like a start up.

We make our living in our clients offices and understand the business from their perspective. And we are building solutions to help overcome challenges, especially in this tough environment. To that end, we view mortgage servicing and default servicing as having four C’s. The three C’s we traditionally think about, which is credit, capacity and collateral, but also layer in the customer aspect.

We know cost of acquisition, the cost of maintaining a relationship, the cost of having effective calls to action for consumers. And we have invested in Cloudvirga to deliver a customer journey. We have informative research to provide comprehensive solutions for credit and capacity and Stewart Valuation Intelligence, and Stewart Centralized Title Services.

To give insights and surety on the value and ownership of the asset. And we’ve also invested in data and technology solutions like PropStream and NotaryCam to drive transaction efficiencies. And I think you’ll hear in a little bit from Suzanne NotaryCam and the way NotaryCam is driving a digital strategy for lenders, those same efficiencies extend into servicing and default servicing world, the IR team is building out a best in class offering.

On data analytics for whole portfolios, including propensity scoring. So you would know ahead of time if your consumer is experiencing some sort of distress and their ability to pay or some other item is affecting their life in a way that’s affecting their credit score. One of the challenges is being able to address consumers where they live, getting effective calls to action so that we can help them.

Yeah, I think there’s no servicer in this country that wants to have a consumer go through foreclosure. Everyone is aiming at the loss mitigation options, vigorously pursuing that the tools allowed for them by Fannie, Freddie, FHA, VA, and others. To ensure that consumers stay in their home and a lot of the Stewart product sets that we’re rolling out to that end are aiding in that.

We also are in the process of standing up a doc prep platform that’s intended to aid in assignments releases, but also growing segments like qualified assumptions. We’re seeing more and more qualified assumption activity in the servicing space that quite frankly, it was unexpected, but given the rate volume today, people that are in that.

2.5 to 3% fixed 30 year rate that have the ability to provide a assumption to a prospective future purchaser that adds value to the transaction. And it’s a tough item for servicers to staff for, and we think we have solutions for it. So I, when I think about Stewart, I think about more than just title and closing, I think about the full life cycle of products and services and really being a partner to our lenders, our servicers, any time in the life cycle of their file.

Marvin Stone: Yes, we can say that Stewart is more than just title, right? Absolutely. Peggy, you’ve been with Stewart for a long time and you’ve got a very robust operation. What makes Stewart different from other players in the default space specifically?

Peggy Dalton: I think the advantage that we have in our default offering is that we’ve been here for a while.

We were solid performers in the early 2008 rush. And what we learned is. We partnered up with our lenders, and we believe that we’ve come up with a solid kinder balance in the early default stage. And what I mean by that is it’s more consumer friendly. It’s more of an advisory opportunity. So we’ve built around that so that.

Our clients can have a solid success in the early default stage. One thing that we’ve invested in is the opportunity to provide valuations up front. There are so many sellers right now or owners in that default space that have, they have equity in their property. So the best thing for us to do is partner up with our lender partners and provide them with good valuation services.

We also getting to know your audience in that default, the pre, the early stage, you have opportunities. If there’s a reverse mortgage opportunity, we have a product for you. If in fact the workout stages are not an option, we have one of the best default operations in the country, I feel. And that offer would allow pre foreclosure property or title work.

It would include REO, but it also includes a deed in lieu possibility. So I think that whatever the service that’s required, we have a support mechanism in place with our default side as far as doing business with Stewart. I don’t think there’s an easier group. Just the personnel is the number 1 thing that we offer.

We’re listeners. We listen to what our clients want, integrations, APIs. We listen to what they’re investing in. We make sure that we’re good partners in that space. And then as far as what Thomas mentioned earlier, doc prep is a big portion of the workout stage, and it’s also a big portion of the default stage, so we’re heavily investing in that side as well.

So I think that as a default partner, the thing that Stewart steps out ahead of everyone. Is that 1 more good partners? We know what the product is that our clients want, and then we make sure that we’ve got a good solution for them. And we also listen to each partner. Everyone focus on a different milestone.

They focus on a different offering. We make sure that we’re a good partner and it’s not. One offering for the whole default piece. It’s a one size fits all for what you need.

Marvin Stone: Thanks, Peggy. Yeah, that’s one thing we’ve always talked about is your group’s ability to really customize around servicers needs and around their milestones and their workflows.

Susan, we don’t often think about remote online notarization really in relation to the servicing space. Can you tell us how NotaryCam, which is now a Stewart company, has been an innovator in this space and really brought about the digitization of loss mitigation?

Suzanne Singer: It really has been a journey. And about having a great reputation and fantastic partners.

We were approached about 2 years ago by Ruth Ruhl PLC to find a better way to get the modification packages she prepares for clients executed. The challenges within the traditional process created unnecessary delays, redraws, extensions, which cost her clients money. We determined that RON was an ideal candidate for completing these transactions, which has proven to be very successful.

We established a pilot program. Perfected the process and then shifted into full gear in early 2023 by leveraging run. We are able to tackle many of the challenges within the existing process that resulted in extended timelines and additional costs. From there, we were often running the servicers. We work with quickly realize the benefits of Ron, including direct cost savings of almost 60 percent through reduced cycle times and therefore reduced total loan costs, eliminating of shipping costs.

Reduced errors and higher execution rate. Less tangible, but also important, RON offers a better borrower experience. When you think about it, these borrowers are already experiencing financial hardship and often can’t afford or don’t have the ability to take off work and go sign documents in an office somewhere.

Ron lets the borrower close at their convenience from anywhere at any time convenient for them, not limited to traditional office hours. The program has been so successful. We have added additional document. Providers, including a surety and are expanding to additional vendors. In keeping with our focus on the digitalization of the closing process, we can also close on e notes for loan modifications.

The number of participating servicers has doubled and continues to grow month after month. No surprise when the value ahead speaks for it with savings of up to 60%. And Ruth Rule was first drawn to us because NotaryCam is a pioneer in the space, but also because of our being owned by Stewart.

Marvin Stone: Thanks, Suzanne. And to wrap it up, I think all three of you are going to be at the MBA Servicing Conference in Orlando to really talk with decision makers about how the Stewart Lender Services family of companies can improve both the performing and non performing servicing processes that are so challenging. It’s great to talk about servicing once again, for more information reach out to any of our guests today and we’ll make sure the contact information’s in the screen below.

Ready to get started with our team of experts?

Get in touch with us today to speak to one of our real estate valuation experts and learn how SVI can help your organization succeed.