Stewart in the Studio

Home Equity – Reduce Costs and Speed Time To Close with Proven Strategies

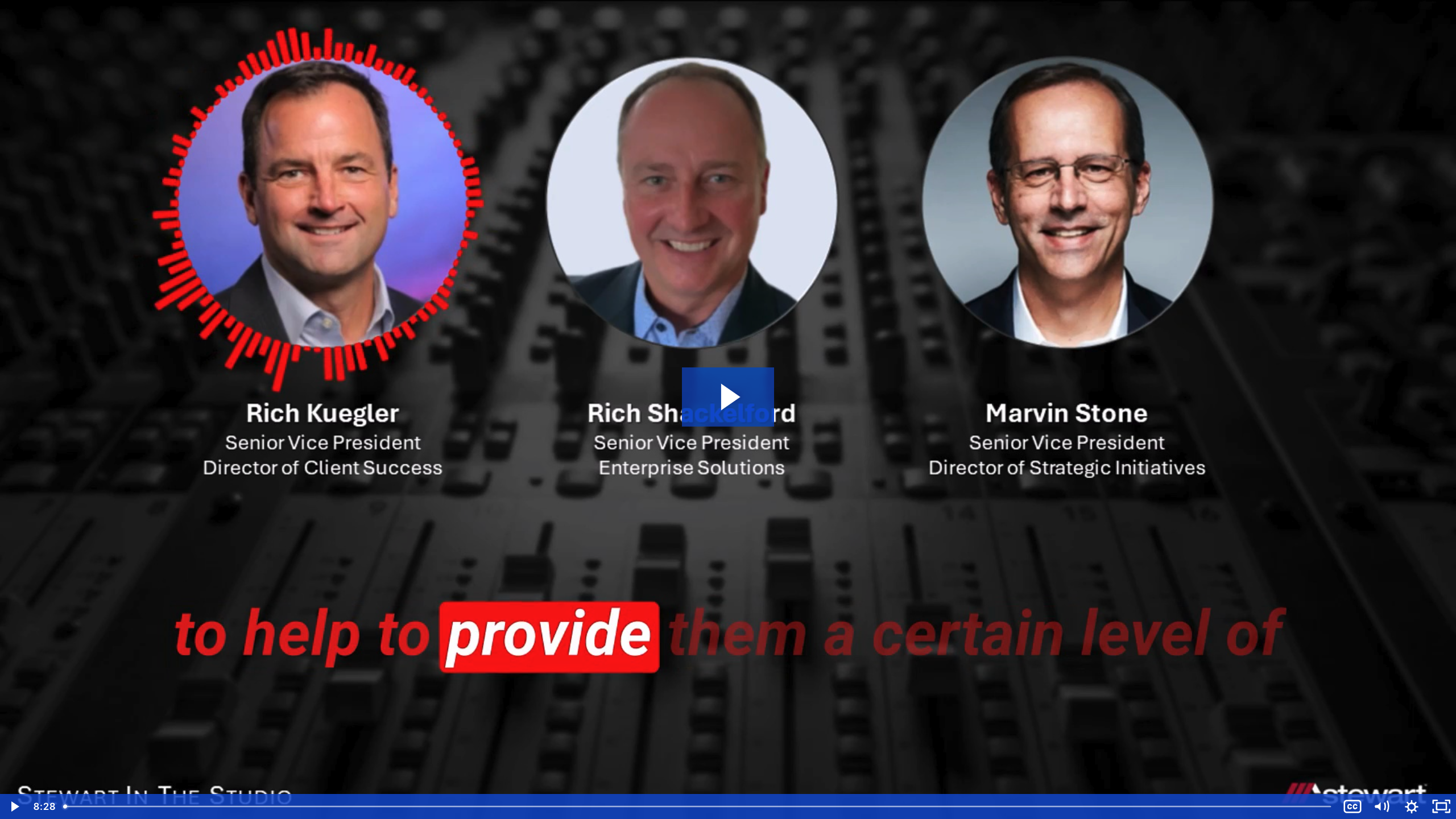

Stewart in the Studio, hosted by Marvin Stone, SVP, Strategic Initiatives, is a fast-paced monthly podcast focused on issues vital to the mortgage lending industry. Tune in each month as Marvin and industry thought leaders discuss important trends and timely topics.

To speak to a Stewart Lender Services expert, please fill out the form to the right – we will get back to you shortly.

Stewart in the Studio Form

Episode Notes

- Guests include: Rich Kuegler, SVP, Director of Client Success & Rich Shackelford, SVP, Enterprise Solutions

- This episode focuses on how to improve speed-to-close for home equity loans.

- Different strategies in processing and underwriting where cost can be taken out of the home equity lending process.

Speaker Bios

Speakers for this episode include:

Marvin Stone

As Senior Vice President, Director of Strategic Initiatives for Stewart Lender Services, Marvin Stone is working on the digital transformation of the transaction process for Stewart’s full range of services that cover the entire mortgage lifecycle. He also contributes to industry technology by participating in MBA’s MISMO Title and Settlement Community of Practice and being part of Stewart’s generative AI council.

Stone has been with Stewart since 2007 and has managed various technology, process and compliance initiatives for the direct, agency and centralized title divisions. Before joining Stewart, he was CIO for a large title company on the West Coast and held strategic roles with other national underwriters and mortgage lenders.

Stone is a frequent speaker at industry events and is sought out for his commentary on industry trends.

Episode 9 Transcript

View Full Transcript

E9: Home Equity – Reduce Costs and Speed Time To Close with Proven Strategies

Marvin Stone: Hey everyone. Welcome to the April episode of Stewart In The Studio, where we’re looking at how we can improve speed to close for home equity loans.

Today, I’m joined by Rich Kuegler and Rich Shackelford, known affectionately here at Stewart as Kuegs and Shack. Gentlemen, let’s start with the state of the market. The Wall Street Journal’s latest quarterly survey of business and academic economists shows forecasters ratcheting up their expectations for economic growth, inflation, and, of course, the level of future interest rates.

With rates now expected to remain at higher levels, what are home equity lenders thinking about the market out there? Thanks

Rich Kuegler: Marvin, it’s really interesting because at the beginning of the year, there was a lot of discussion around rate cuts and about the impact that was going to have on consumers, and that’s just not materialized.

A number of home equity lenders are really seeing this as a time when there is home equity eligibility out there. Certainly at the current 7 ish rate, not a lot of homeowners are available or eligible for refinance. Home equity becomes a good vehicle for them. Whether it’s a loan or a line of credit, there are consumer banks and credit unions that have been focused on home equity lending for quite some time.

And even some IMBs have been joining the crowd to take advantage of this product offering as a way to satisfy their consumers. A big concern, though, and it was the number one issue in 2023 was how can they reduce cost? And so there are a number of different ways in the fulfillment process in the application process but mostly in, in processing and underwriting where cost can be taken out of the home equity lending process.

And that’s been a real important factor for profitability and home equity lending.

Marvin Stone: Got it. So definitely a big focus there. So let’s talk about how home equity lenders think about risk in relation to cost. The national median existing home price we just saw NAR came out said it rose 4. 8 percent in March from a year earlier to $393,500.

And valuations are probably coming in on the money, but home equity lenders need to manage the cost versus the risk. Shack, can you shed some light on that with respect to the valuation and appraisal aspect?

Rich Shackelford: Yeah, I sure can, Marvin, and thanks for having me on today. I would say that in the home equity space, it’s really about your risk tolerance as a lender, where you want to position yourself, whether it’s with a simple AVM, and that’s a single state AVM, or if you need to have a cascade of AVMs, and you can pair that with more condition report products, and also move into a full appraisal or a drive by appraisal.

It just depends on what your threshold of risk really looks like for the valuation of the customer you’re lending to.

Marvin Stone: So the audit piece is obviously, a huge piece in regulated institutions and matching the risk with the cost is a balancing act. Does that sound about right? It does.

Rich Shackelford: You’re spot on with that, Marvin.

Marvin Stone: Yeah, for sure. So Kuegs, what about the title side? What are home equity lenders doing to manage costs while still making sure there are no surprises on the title side?

Rich Kuegler: As Shack mentioned, there’s definitely a way that you can match the cost of the different products and services that you use to the risk of the given transaction.

There’s no requirement for a full title policy, just like there’s no requirement for a full appraisal, but there are a number of different services and verifications that are available to help confirm the vesting, look at lien position, get the legal description that you need for your for your mortgage instrument, but there’s not, again, not a need for title necessarily.

So a number of options that lenders have looked at are things like some more database driven product to fulfill searches using current owner searches, also known as owners and encumbrance or short searches. And then maybe even wrap that with an E & O policy to help to provide them on a certain level of guarantee that that will help protect the lender in the process.

And then that same thing holds true even. Through settlement and closing where it’s really important for lenders to find the type of closing to close where the borrower wants to close so they may want to go to a branch. They may want to stay in their home. They may want to take advantage of a hybrid closing or even a full remote online notarization type of closing.

Because customer experience is a huge factor right behind cost with the home equity lending community.

Marvin Stone: Okay, so the customer experience, consumer experiences is always top of mind. So Shack, with that, the home equity space has become more competitive in recent years. What With some highly capitalized venture backed FinTech players entering the space to really re engineer the consumer experience.

I know you’ve been to a couple of conferences lately focused on the home equity space. What are you hearing from home equity lenders about the need to improve the consumer experience?

Rich Shackelford: Yeah, Marvin, from the conferences that I’ve attended lately, from a lender’s perspective or a credit union’s perspective, it seems like the customer experience is critical.

Rates and costs are important, but a smooth process is king. Lender process needs to be customer centric, and so does your service providers. And that’s where having a single source provider is really a huge benefit for our credit union and lender clients.

Marvin Stone: Yeah, makes sense. So finally, we probably should mention the latest proposal that just came out the other day from FHFA where Freddie Mac could purchase home equity loans that was just announced that we saw this, Cougs, we saw this years ago, and there wasn’t a lot of volume when this happened the first time, but I’m wondering if you think this could become a reality and maybe even a game changer in the home equity space.

Rich Kuegler: It’s really interesting to think about because if you think about the proposal in its essence is really that it provides some additional liquidity into the market for home equity loans, which in a lot of time it’s been. It’s been taking some time for. For that to become a dominant part of the home equity market, a lot of lines of credit today, and Fannie doesn’t have a line of credit product.

And that’s not contemplated in this, as far as I could tell so far, but that could result in more home equity loans being made as well as more entrance into the market. Meaning again, that’s a better option for consumers to get them more options for home equity lenders.

Marvin Stone: That’ll be interesting to see how that plays out.

Kuegs, Shack, thanks so much for sharing your insights today. Links to the articles we mentioned will be in the post along with your contact information for anyone wanting more information about reducing costs and managing risk and home equity, but really focusing on that speed to close and everyone out there. Thanks always for tuning into Stewart In The Studio. We’ll see you next time.

Ready to get started with our team of experts?

Get in touch with us today to speak to one of our real estate valuation experts and learn how SVI can help your organization succeed.