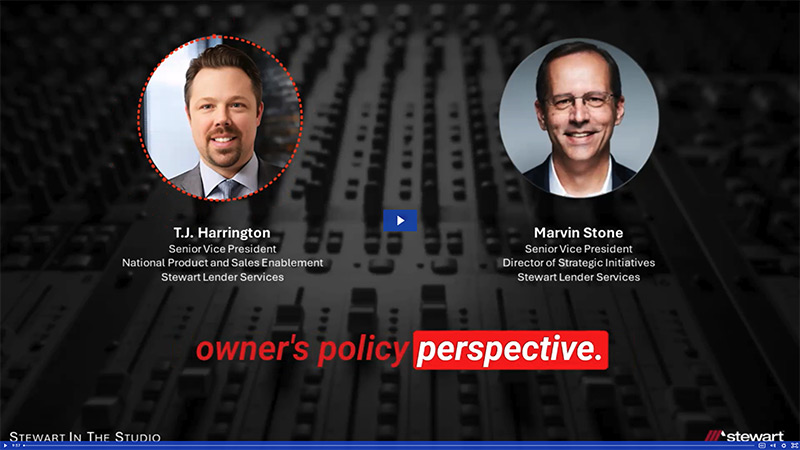

Stewart in the Studio

The Value of Title Insurance – What Lenders Need To Know

Stewart in the Studio, hosted by Marvin Stone, SVP, Strategic Initiatives, is a fast-paced monthly podcast focused on issues vital to the mortgage lending industry. Tune in each month as Marvin and industry thought leaders discuss important trends and timely topics.

To speak to a Stewart Lender Services expert, please fill out the form to the right – we will get back to you shortly.

Stewart in the Studio Form

Episode Notes

- Title industry is seeing increased change and innovation.

- 3,300 counties nationally, with very few state standards makes consistency a challenge.

- Attorney opinion letters. There are limits and concerns about what the wrapper covers.

- Misconceptions as to what title insurance is, how it works and the value of title insurance.

- With innovation coming out, make sure it still meets your risk appetite and balance that with being competitive on fees so that you can win deals.

Speaker Bios

Speakers for this episode include:

Marvin Stone

As Senior Vice President, Director of Strategic Initiatives for Stewart Lender Services, Marvin Stone is working on the digital transformation of the transaction process for Stewart’s full range of services that cover the entire mortgage lifecycle. He also contributes to industry technology by participating in MBA’s MISMO Title and Settlement Community of Practice and being part of Stewart’s generative AI council.

Stone has been with Stewart since 2007 and has managed various technology, process and compliance initiatives for the direct, agency and centralized title divisions. Before joining Stewart, he was CIO for a large title company on the West Coast and held strategic roles with other national underwriters and mortgage lenders.

Stone is a frequent speaker at industry events and is sought out for his commentary on industry trends.

T.J. Harrington

T.J. Harrington serves Stewart Lender Services (SLS) as Senior Vice President of Sales and Product Enablement. In this role, T.J. focuses on expanding Stewart’s reach and influence in the title, appraisal/valuation and credit/verification industries.

His extensive experience includes serving as general counsel and strategy-focused roles at major lender services and bank-owned mortgage and title operations.

Episode 10 Transcript

View Full Transcript

E10: The Value of Title Insurance – What Lenders Need To Know

Marvin: Hi, TJ, for those who don’t know you yet, just share a little bit about your background and how you came up through the title industry.

T.J.: Sure, Marvin, thanks for having me here today. Nice to meet everybody virtually – T. J. Harrington with Stewart Lender Services.

I started my career when I was 15 years old working at a registry of deeds in Worcester, Massachusetts. So it was one of my first jobs and I got bit by the title bug and have not left ever in clerked at summers during college at the registry of deeds. I went on to law school with a focus on real estate.

I came at the tail end of the foreclosure crisis. So really cut my teeth doing title curative in the foreclosure space, retiring mobile homes, walking down to the window. I always joke about Betty Sue at the window, but she’s a real lady. She’s in one of the counties in South Carolina where I do have my law license.

And figured out very early on that I loved title and loved working in the business and wanted to grow and learn more and ended up at a large national provider based in Pittsburgh, moved up to Pittsburgh with my poor, lovely wife, been schlepping her around the country to do this title thing. And eventually landed in Charlotte, working for a bank for America and supporting land safe.

And ended up in another wonderful national title operations with appraisal credit flood with other insurance products, really lender services in general, my role at Stewart is a little bit different and that I’m in a non legal role. Stewart’s made so many really amazing acquisitions in the last 5 years.

And the idea now is to bring them to market to have a combination of products that move the needle for our lender clients and really begin to unlock the true potential of all the acquisitions. I think as standalone companies, each company has been amazing and done very well, but together we’re better when we think together and bring all of our products in alignment and engage our clients in a holistic manner that we’re able to unlock value.

Marvin: Title’s kind of in the spotlight and a lot of people are looking for change, but in a lot of different ways. So talk a little bit about some of the high points you’re following and how those proposals may or may not work.

T.J.: Yeah. So I, it’s a great segue, Marvin. We are in a space where we’re, we’ve been ripe for disruption for some amount of time and people are saying, Hey title’s expensive.

Title’s arcane. And there’s Some truth to it. There’s such a thing as a national title business. We’re 3,300 counties nationally, and it’s ground up. It’s counties doing what they’ve got to do. Very few States put their boot down and say, here are the standards here, what you have to do.

And so you have some disparate problems. Every county is different than every other. There’s risk to it from a title search side, but also there’s some machinations around recording and some difficulties in getting things done. With that said, you have the powers that be looking at the cost to get consumers into housing with the rise in housing prices, with the rise in interest rates, with the rise in cost of fulfillment for mortgage, everyone is very price sensitive and they’re trying to say, what can we do to nibble at the edges?

What can we do to really make a difference? And, one of the tall bars is title insurance. And speaking from the lender services side, we went through this exercise probably 10, 15 years ago, when we really rolled out the centralized rates and scale production and bundle settlement fees. We have not necessarily had that same exercise on the more retail side of it.

I think that we’ve done it very successfully in the lender services side of it, but that is a very specific fulfillment model. And so what is being talked about our ways to disrupt the broader industry. So one of the first things that, that we talked about has been the attorney opinion letters.

There’s limits and concerns about what that wrapper actually covers that backs the attorney opinion letter. There’s potentially statute of limitations issues. There’s the potential that down the line, the wrapper around it gets declared an illegal title product written in surplus lines for those that are savvy to insurance.

And so a lot of the lenders in the market say that title risk is part of my reps and warrants that I make to, to the GSEs to FHA to 2nd, the secondary market and ultimately AOLs didn’t take off because despite the marginal cost savings, the lending community did not feel that AOLs properly secured them from counterparty risk.

And that’s the number one thing, when we think about what we do in title, we protect the consumer from an owner’s policy perspective. We protect the lender from a loss of priority or lean position. And there’s some technicalities around that. So really it’s what can we do to skin the cat and what can we do better?

But I think there’s also some significant misnomer as to what people think title insurance is, how it works, and we don’t do ourselves any favors, so I don’t think that we we’ve ever properly explained the value of title insurance. I see the press releases from ALTA, and they do a really great job calling out some of the anecdotal use cases where title insurance has made a difference and been great for consumers, been great for lenders, but I think that kind of glosses over it.

The actual boots on the ground, hands in the dirt kind of approach. Title insurance is unlike any other insurance out there. You pay it one time at closing. It covers for, it covers you for the life of your ownership of the property. And it’s not perspective looking. It’s retrospective looking. The idea is that title insurance, it’s risk management and claims prevention process.

It’s an ounce of prevention is worth a pound of cure. Our goal, and there’s going to be a paper coming out sponsored by ALTA, where 90 to 95 percent of the premium is put towards loss prevention. There is so much loss prevention that goes in and the claims rate that we see is a product of the hard work we put in of the networks of underwriting councils on a state by state basis that monitor changes in laws that provide risk assessments.

I get daily bulletins in my inbox from underwriting councils in various states talking about new issues, particular items that have come up changes of law management instructions to agents how to handle particular risks. There’s seminars and education put in there’s audits. And there’s monitoring of escrow accounts through Rynoh that we do for every single agent with the reconciliations at the month.

There’s a lot of risk management that goes on, not to mention the cost of production. So I think that we see a lot of, focus on the claim side and saying, why are claims low relative to the premium, not understanding that it’s a loss prevention product. I joke about it, that it’s manufacturing with a good housekeeping seal of approval on it, and it’s the underwriter saying for my direct operations and for my agents, I stand by the work that they’ve done and I have trained them. I’ve educated them. I take on giving them best advice and practice and I put my reserves behind the process. And that’s, I think something that we need to speak more about the process related to title insurance.

Marvin: So for the lenders who are listening to this conversation and all the complexity around title, what’s the takeaway?

What would you tell lenders the takeaway is here?

T.J.: Yeah, that’s a good question. There’s a ton of conversations about how to make title better. There is still reps and warrants on title are not changing right now. And so really from a origination standpoint, if you’re a large Institutional bank making mortgages.

You have responsibilities to the OCC for safety and soundness. If you’re an IMB and you’re have reps and warrants to secondary market, and that’s your business, right? A losses from repurchases could torpedo it. I think you have to give a hard look at the innovation that’s coming out, making sure it still meets your risk appetite and balance that with being competitive on fees so that you can win deals.

I think there’s that dynamic tension right now. And, I’d say, give me a call. I’m happy to chat it through with you. I think, one of the things that we pride ourselves at Lender and Steward Lender Services is being consultative partners who give right answers, not the answers necessarily that pull you into our product set. I think we’re really thoughtful about having the right answers for our client and giving them the goods and bads and helping them make the right decision.

It’s one of those wait and see moments. And there is so much going on outside of just title in general, in the mortgage space, in the servicing space, especially there’s a, there’s just so much coming out of DC because of the election. And so it’s really hold on tight. Let’s get through this, the next probably six months or so until we get some clarity and we’ll figure it out, but let’s do it together.

Ready to get started with our team of experts?

Get in touch with us today to speak to one of our real estate valuation experts and learn how SVI can help your organization succeed.